December: 2022 Recap & 2023 Forecast

This last update (published early because of upcoming holidays) concludes my 2022 monthly series which started with my January roadmap.

In essence, 2022 had been a movie of transition from Quad 3 (Inflationary Bust) to Quad 4 (Disinflationary Bust), — with central bank rate hikes (read: decelerated credit impulse) as the catalyst. The causes and effects are detailed in the following framework I constructed back in 2020:

The prominent characters in this movie are:

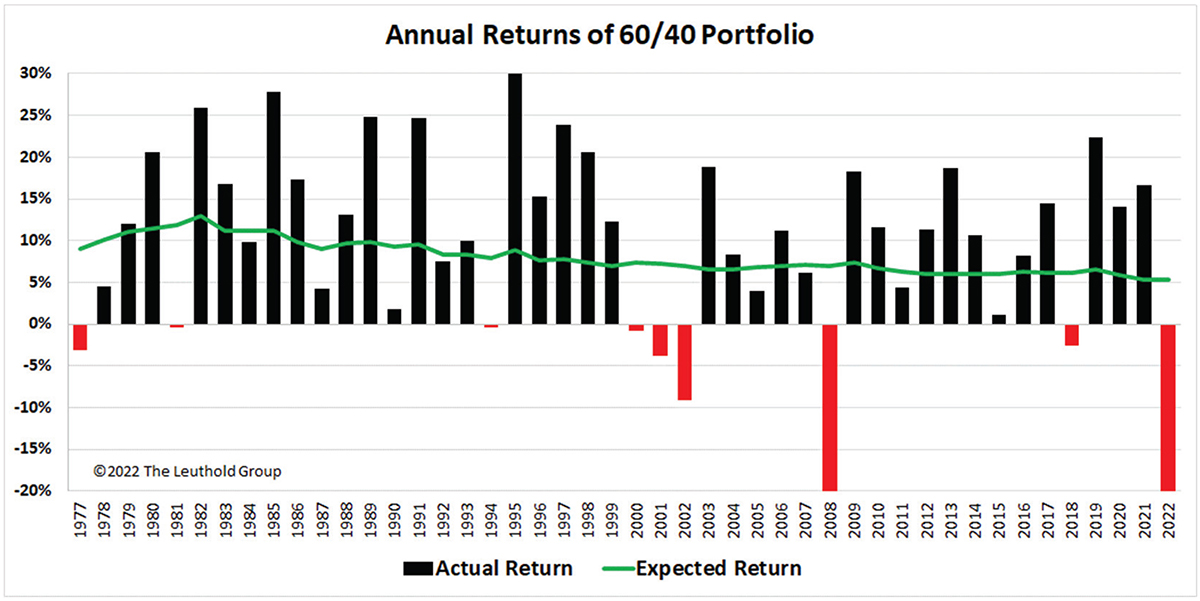

- Stocks and bonds, long inversely correlated, had become positively correlated during Inflationary Bust (Quad 3), blowing up all 60/40 portfolios in the process (see chart below). This relationship will revert as Quad 4 takes root in 2023.

- Real estate (not to mention auto) prices declined sharply (without the benefit of speculative bounces enjoyed by equities). They will further decline as Quad 4 takes root in 2023, with the “reverse wealth effect” far more felt as recession deepens.

- Techs (the most procyclical equities)’ 20-year run of mad growth came to a crash in 2022 with “easy money” withdrawn. That leaves tech companies scrambling to lay off workers in 2023. Increased government regulatory actions will further defang Google, Apple, Amazon, and Microsoft. Meanwhile, with various issues ailing Meta, Twitter, and TikTok, the age of social media hit a wall in 2022. Coming out of this recession (years away), “Techs” will have been redefined.

- The fall of FTX/Alameda cascaded into liquidity problems for a whole host of other participants (Gemini, Genesis, etc.) in the crypto-verse. “Crypto winter” had begun and more drama will no doubt unfold in 2023. But this does not mean the death of Bitcoin or Etherium (because everyone yearns for a smart contract world after countless revelations of fraud in the traditional financial system since the 1990s). Just like early challenges faced by the railroad industry in the late 19th century, 2023 may well be a “What doesn't kill you makes you stronger” (read: come up with creative solutions to problems now exposed) year for the Crypto-verse.

2022 was a year of asset revaluation (caused by Fed’s “reverse gear”). The S&P PE dropped from around 30 at peak in January to now around 18 in December. 10 year treasury yield had nearly tripled from around 1.2% in January to around mid-3% in December. Median home prices had dropped double digits since May, 2022 in virtually every market. We are nowhere near done in this revaluation. Notwithstanding any year-end “Santa Claus Rally” in equities, 2022 ended with us free-falling halfway from the top of the Empire State State Building, muttering to ourselves: “So far so good…”.

But the global yield curve had only just gone negative (see chart below). Recession will surely deepen in 2023.

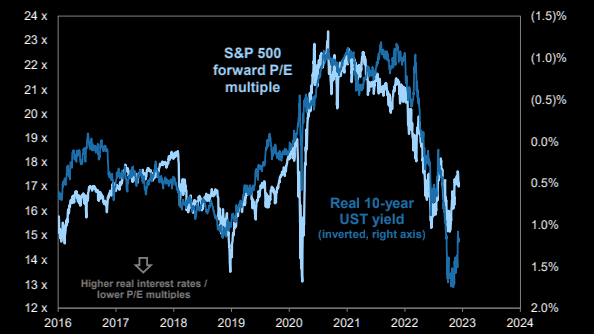

In a typical recession, earnings take a 25% haircut (from both sales decline and margin compression). Current equity valuations do not have this priced in, thus equities will continue to decline (via multiple contraction) in 2023 to catch up with real-yield rise (see chart below).

Until credit crises (aka Black Swans, aka Lehman 2.0) emerge, the Fed won't pivot. Powell desperately wants to avoid repeating Arthur Burns’ mistake: Prematurely cut rate when the real yield was still materially negative, causing inflation (especially the “sticky” service component) to creep back up and form a secular wage-price spiral (a la the 1970s). See chart below:

An even more important incentive for Powell not to pivot prematurely is the elephant in the room nobody talks about: The Fed must keep the US dollar index elevated before the impending global currency reset. Quad 4 is the 2nd phase of the Inflation->Deflation->Hyper-inflation->Currency Reset progression path. In the transition from now to currency reset (see 2nd to last paragraph), the Fed intends to support the US dollar as best as it can.

The Fed may pause however, if and when the 3-month annualized (headline and core) CPI (especially the service component ex-shelter) drops below the current terminal Fed Funds Rate of 5%. Absent Black Swans, The Fed aims to hold rates there and call it a “soft landing”. There is no chance of that happening because the world is essentially insolvent with Fed Funds Rate at 5% (i.e. global sovereign debt vis-à-vis global GDP cannot handle Fed Funds Rate that high). As well, you don't reduce the book value of the most pristine collateral (Treasury bills and notes) — via Fed Funds Rate hikes— in virtually every bank of systemic importance at the insanely rapid pace (see chart below) without creating liquidity problems within the global banking sector. And we all know liquidity problems are the genesis of insolvency.

Referring to a familiar Silicon Valley motto, move fast equals break things. An even bigger threat looms in the larger shadow banking sector (i.e. unregulated non-bank financial institutions like private equity firms and their investors, — pension and other funds, and insurance companies) which is even more leveraged and less transparent (for lack of timely mark-to-market per regulatory requirements). Powell hopes these liquidity problems will be contained in the REPO market, which he can quietly diffuse behind the scene as he did back in 2019. My bet is, “cascading flashpoints” will lead to serial insolvency (not just liquidity) events. History attests to that:

Serial Black Swans are a feature of all 4th turnings, and I fully expect sightings in the first half of 2023. If Black Swans appear in Q1, then the December 2022 rate hike will turn out to be the last before pivot. Otherwise The Fed will probably have one more hike in February, 2023 before Black Swans appear in Q2 of 2023. We have waited for “Lehman” long enough; and “Lehman” (think the >$1 Quadrillion of derivatives out there) is overdue. Things will break soon and force the Fed to pivot.

Much of the optimism in equities is rooted in China’s “re-opening from Zero-Covid lockdown”. I think this optimism is misplaced because even fully reopened, China will not be able to create the same credit impulse as it did in 2009 due to current untenable debt levels and dwindling Dollar reserves. Supply chains are not only diverted from China but severely disrupted within China (reflected by 80% drop in fright rate) due to Zero Covid lockdown, — which will take a long time to normalize. Last but not the least is that China will be dealing with structural problems (anemic domestic consumption growth and 40% of economy mired in the collapsing real estate sector) for years to come. Facing more deflationary pressure (from de-leveraging) than other economies, China will not be a positive contributor to global economic growth in 2023. In fact, it may be an originator of Black Swan events in 2023, — through default on U.S. dollar denominated loans reverberating through the global banking system. (This is not to minimize the strategic advantage China architected for itself by cementing relationships with Iran and Saudi Arabia in 2022; but that won’t pay dividends in 2023.)

Given the preceding, I aim to execute my playbook for the first half of 2023 somewhere between end of FOMC in February and T-bill maturity in May (depending on Black Swan sightings). The playbook is all about building a barbell portfolio of Treasuries in a “year of bonds”. The only question is how lopsided that barbell needs to be, depending on how the yield curve “morphs” in anticipation of the Fed pivot.

Fed pivot in 2023 will end Disinflationary Bust and start Disinflationary boom (Quad 1). Treasuries will rally and stocks will fall. This is where the barbell portfolio comes in. But this phase will quickly transition to Inflationary boom (Quad 2), possibly even before 2023 ends. Ample sideline cash will then be put to work in scarce resources such as commodities (fueling a new Commodity Supercycle which can easily feature $100 to $150 per barrel oil by 2024). It will also bottom-fish the most beaten up early cyclicals like Techs. A new bubble will quickly form afresh, probably with the US Dollar declining at the same time. This is the Crack-Up Boom phase of the credit cycle whereby financial assets (especially equities) rise rapidly and sharply with a second wave of “hyper” inflation in the 2024–2025 timeframe ( watch deflationary Japan closely in this phase). Though not an analog for the US, this 2019 Venezuelan stock market chart shows how equity markets behave just prior to currency collapse (when “cash is trash”):

In anticipation of “hyper” inflation, long bond rates may rise substantially as early as late-2023 to 2024, destroying the bond market (i.e. rendering the 2022 bond market rout a “walk in the park”). This situation is especially likely if Japanese investors dump US treasuries in favor of Japanese JGBs given Japan’s recent widening of its Yield Curve Control band. If so, then the elevated cost of capital will plunge the world into even deeper recession in 2025–2026, and finally bankrupt global governments (i.e. major industrial countries all going the way of banana republics with capital control before currency collapse), creating the pretext for launching the long-in-the-works global currency reset.

I hope I'm wrong, but as of now, the preceding scenario seems the most likely (and preordained) script for the sequel to 2022.